In today’s rapidly evolving economic landscape, staying informed about market and economic trends isn’t just good practice for small business owners, it’s essential for survival and growth. The difference between businesses that thrive and those that struggle often comes down to how quickly they recognize and adapt to shifting market conditions.

November 2025 presents a particularly complex economic environment. From AI-driven market volatility to ongoing policy changes under new federal leadership, small business owners face both unprecedented opportunities and significant challenges. Whether you’re running a retail storefront, operating a service business, or managing an e-commerce platform, understanding the current market dynamics can help you make informed decisions about everything from inventory management to hiring strategies.

This comprehensive markets update will walk you through the key trends shaping the business landscape this month, helping you identify opportunities to capitalize on and risks to avoid. By staying informed and taking proactive steps, you can position your business not just to weather economic uncertainty, but to emerge stronger and more competitive.

Current Market Overview

Stock Market Turbulence and Tech Sector Concerns

November 2025 has kicked off with notable volatility in financial markets. The Nasdaq Composite experienced a sharp decline of more than 3% in the first week of the month, driven primarily by concerns about AI stock valuations after an extended rally. Major technology companies like Nvidia saw their stock prices drop over 7%, signaling a potential correction in the tech-heavy market segments that have driven much of the recent bull run.

Wall Street’s major financial institutions, including Goldman Sachs and Morgan Stanley, have issued warnings about potential market corrections ranging from 10% to 20% within the next 12 to 24 months. While these predictions don’t guarantee a downturn, they reflect growing caution among institutional investors about current market valuations.

Inflation and Interest Rate Environment

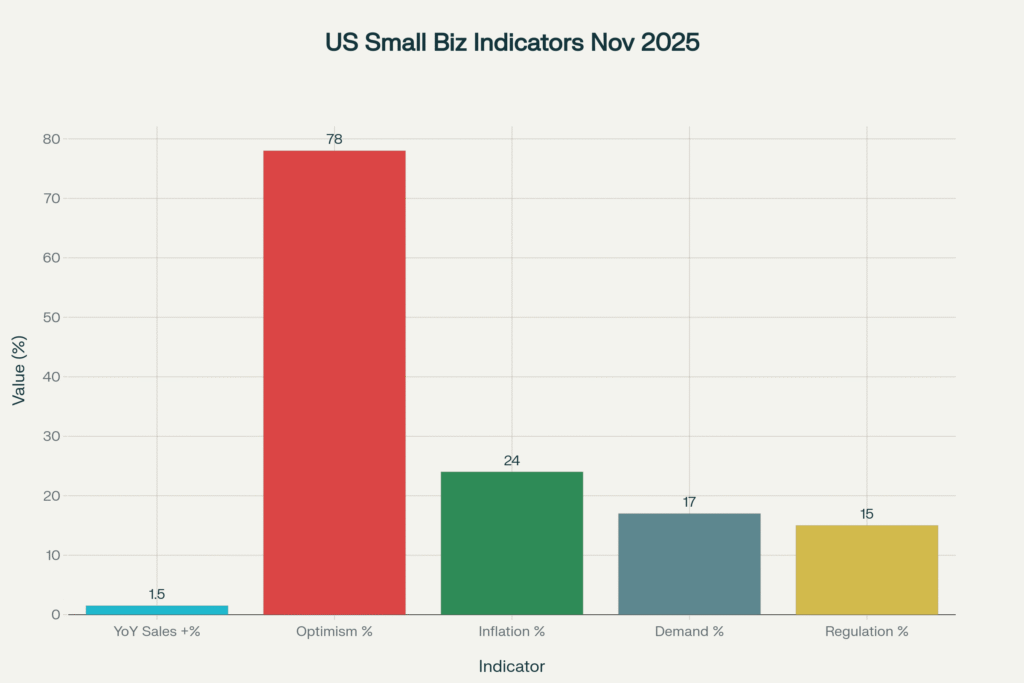

Inflation remains a persistent concern, though the pressures have softened compared to the peaks of 2022 and 2023. Approximately 46% of small businesses still cite inflation as their top challenge, but this represents a gradual improvement from earlier in the year. Consumer prices continue to affect purchasing decisions, which in turn impacts small business revenue streams.

On a more positive note, the Federal Reserve has implemented rate cuts that are beginning to stimulate borrowing opportunities. Lower interest rates make it more attractive for small businesses to finance expansion, invest in new equipment, or refinance existing debt at more favorable terms. This shift in monetary policy represents one of the most significant opportunities for business growth in the current environment.

Consumer Behavior and Spending Patterns

Consumer trends continue to evolve in 2025, with several notable patterns emerging. E-commerce and social media shopping have cemented their positions as critical sales channels. Approximately 40.4% of online consumers made purchases through social media platforms in the past year, and social media user growth is projected to increase by 26 million users between 2024 and 2029.

However, proposed U.S. tariffs on imported goods could reduce consumer spending power by $46 billion to $78 billion, potentially dampening demand across multiple sectors. Small businesses that rely on imported products or serve price-sensitive customers need to factor these potential impacts into their planning.

Regulatory and Policy Landscape

The ongoing government operations challenges have created uncertainty in the business environment. The current government shutdown, which has extended to 38 days (making it the longest in U.S. history), has resulted in data gaps and delayed regulatory guidance that businesses typically rely on for planning purposes.

Additionally, new tax policies and potential regulatory changes under the current administration could significantly impact small business operations, particularly regarding labor laws, environmental regulations, and tax incentives. Staying informed about these evolving policies is crucial for compliance and strategic planning.

What’s Shifting for Small Businesses?

Cost of Borrowing is Becoming More Favorable

One of the most significant shifts affecting small businesses in November 2025 is the improved access to capital. The Federal Reserve’s recent rate cuts have made borrowing more affordable, creating opportunities for businesses to:

- Refinance existing debt at lower rates, reducing monthly payments and freeing up cash flow

- Invest in expansion projects that were previously cost-prohibitive

- Purchase new equipment or technology that can improve operational efficiency

- Build working capital reserves to cushion against future uncertainty

Small business owners should review their current loan structures and consider whether refinancing makes financial sense. Even a 1-2% reduction in interest rates can translate to substantial savings over the life of a loan.

Supply Chain Dynamics Continue to Evolve

While supply chain disruptions have largely stabilized compared to the pandemic era, new challenges are emerging. Proposed tariffs on imported goods could increase costs for businesses that rely on international suppliers. Companies that source materials, products, or components from overseas need to:

- Evaluate alternative suppliers, including domestic options

- Build larger inventory buffers to protect against sudden price increases

- Pass some costs to customers through strategic price adjustments

- Explore product substitutions that rely less on imported materials

The businesses that fare best in this environment are those that maintain supply chain flexibility and have contingency plans in place.

Workforce Trends and Labor Market Shifts

The labor market presents a mixed picture for small businesses in November 2025. On one hand, small business owners report relatively strong confidence, with 64% indicating their businesses are profitable. On the other hand, 17% of businesses continue to face challenges with recruiting and retaining talent.

A particularly concerning trend is the acceleration of layoffs in certain sectors. October 2025 saw the highest number of announced layoffs since 2009, with 33,281 jobs lost in the tech sector alone, primarily due to AI integration and automation. This trend has several implications for small businesses:

- More qualified candidates may be available in the job market, particularly in tech-related fields

- Wage pressure may ease as competition for talent decreases in certain sectors

- Workers may prioritize job security and stability, potentially favoring small businesses that offer personal connection and long-term growth opportunities

- Automation and AI tools are becoming essential for remaining competitive

Small businesses that invest in their workforce through training, competitive compensation, and positive workplace culture will have an advantage in attracting and retaining top talent.

Technology Adoption is Accelerating

Perhaps the most transformative shift for small businesses is the rapid adoption of artificial intelligence and automation tools. A remarkable 58% of small businesses now use generative AI, representing an 18-point increase from just one year ago. Even more telling, 80% of small business owners express confidence that AI will help them in the future.

This technology adoption is manifesting in several practical ways:

- Automated customer service through chatbots and AI-powered support systems

- Enhanced marketing through AI-generated content and targeted advertising

- Improved financial management with predictive analytics and automated bookkeeping

- Streamlined operations through process automation and workflow optimization

- Better inventory management using demand forecasting algorithms

Small businesses that embrace these technologies early can gain significant competitive advantages in efficiency, customer service, and cost management. However, this also means that businesses that resist digital transformation risk falling behind competitors who are leveraging these tools effectively.

Digital Payment and Financial Technology Evolution

The financial technology landscape continues to evolve rapidly, with new payment methods, digital invoicing systems, and cash flow management tools becoming increasingly sophisticated and accessible to small businesses. Modern payment platforms now offer:

- Instant payment processing with faster settlement times

- Integrated accounting and bookkeeping features

- Fraud protection and security enhancements

- Multiple payment options to meet customer preferences

- Detailed analytics and reporting for better financial insights

Businesses that modernize their payment and financial management systems can improve cash flow, reduce administrative burden, and provide better customer experiences.

Opportunities to Seize

Tax Incentives and Deductions

November is an ideal time to review your tax strategy and identify opportunities to reduce your 2025 tax burden. Several incentives and deductions remain available to small businesses:

Section 179 Deduction: This allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. For 2025, the deduction limit remains substantial, enabling businesses to invest in necessary assets while reducing taxable income.

Research and Development Credits: If your business engages in product development, software creation, or process improvement, you may qualify for R&D tax credits that can significantly offset costs.

Energy Efficiency Incentives: Businesses that invest in energy-efficient equipment, solar installations, or green building improvements may qualify for various federal and state tax credits.

Home Office Deduction: For small business owners operating from home, properly documenting and claiming home office expenses can provide meaningful tax savings.

Working with a qualified tax professional, such as the accredited accountants at Pro Tax Return, can help you identify all available deductions and structure your business activities to maximize tax efficiency. The investment in professional tax advice typically pays for itself many times over through identified savings and avoided errors.

Show Image Alt text: Small business owner consulting with professional tax accountant about financial planning

Grant Programs and Funding Opportunities

Various federal, state, and private grant programs continue to provide funding opportunities for small businesses, particularly those in specific sectors or demographic categories:

- Small Business Innovation Research (SBIR) grants for companies engaged in research and development

- Community development grants for businesses in underserved areas

- Industry-specific grants for sectors like agriculture, healthcare, and green energy

- Grants supporting minority-owned, women-owned, and veteran-owned businesses

Unlike loans, grants don’t require repayment, making them an attractive funding source. However, they often come with specific requirements and competitive application processes. Dedicating time to research and apply for relevant grants can provide non-dilutive capital to fuel growth.

Strategic Refinancing Opportunities

With interest rates declining from their recent peaks, this represents an optimal window for small businesses to refinance existing debt. Consider refinancing if:

- Your current loans carry interest rates 2% or more above current market rates

- You have multiple high-interest debts that could be consolidated

- Your business credit profile has improved since you originally secured financing

- You need to extend repayment terms to improve monthly cash flow

Even modest interest rate reductions can translate to thousands of dollars in annual savings, particularly for larger loan balances. Consult with financial advisors to model various refinancing scenarios and determine the best approach for your specific situation.

E-Commerce and Social Media Expansion

The continued growth of online shopping and social commerce presents significant opportunities for small businesses willing to meet customers where they spend their time. With over 40% of online consumers now shopping through social media platforms, businesses should consider:

- Establishing or enhancing presence on platforms like Instagram Shopping, Facebook Marketplace, and TikTok Shop

- Investing in quality product photography and video content

- Implementing social media advertising campaigns with precise targeting

- Developing influencer partnerships to reach new audiences

- Creating engaging content that builds community around your brand

The barriers to entry for e-commerce and social selling have decreased dramatically, with user-friendly platforms and affordable tools making it accessible even for businesses with limited technical expertise or budgets.

AI and Automation Implementation

With 58% of small businesses already using AI tools, now is the time to join the movement or expand your existing use of these technologies. Practical AI applications for small businesses include:

- Customer service chatbots that provide 24/7 support

- Content creation tools for marketing materials, blog posts, and social media

- Automated email marketing with personalized messaging

- Predictive analytics for inventory and demand forecasting

- Accounting automation that categorizes expenses and generates reports

- AI-powered appointment scheduling and calendar management

Many of these tools are available at low or no cost, making them accessible even for businesses with tight budgets. The productivity gains and cost savings typically justify the investment quickly.

Risks to Watch

Economic Downturn Potential

While small business confidence remains relatively strong, the warnings from major financial institutions about potential market corrections should not be ignored. A 10-20% market correction could have ripple effects throughout the economy:

- Reduced consumer spending as households feel less wealthy

- Tightened credit conditions as lenders become more conservative

- Decreased business investment across the economy

- Potential job losses that further reduce consumer demand

Small businesses should prepare for this possibility by building cash reserves, maintaining conservative debt levels, and diversifying revenue streams. Businesses that enter economic downturns with strong balance sheets and operational efficiency are best positioned to survive and even gain market share.

Tariff-Related Cost Increases

Proposed tariffs on imported goods represent a concrete risk for many small businesses. The potential $46 billion to $78 billion reduction in consumer spending power could impact businesses in several ways:

- Direct cost increases for businesses that import products or materials

- Reduced consumer demand due to higher prices across the economy

- Supply chain disruptions as businesses scramble to find alternative sources

- Competitive pressures as businesses decide whether to absorb costs or pass them to customers

Small businesses should model various scenarios to understand how different tariff levels would affect their costs and pricing strategies. Developing relationships with multiple suppliers, including domestic options, can provide flexibility when faced with tariff-driven cost increases.

Cybersecurity Threats

As small businesses increasingly embrace digital tools and e-commerce, they become more attractive targets for cybercriminals. Cyber attacks on small businesses have increased in frequency and sophistication, with common threats including:

- Ransomware attacks that lock business data until a ransom is paid

- Phishing schemes targeting employee credentials

- Payment fraud and invoice manipulation

- Data breaches exposing customer information

- Business email compromise scams

The cost of a cyber attack extends beyond immediate financial losses to include reputational damage, regulatory penalties, and operational disruption. Small businesses should invest in:

- Regular security training for all employees

- Multi-factor authentication for all business systems

- Regular data backups stored securely offsite

- Updated antivirus and anti-malware software

- Cyber insurance coverage to mitigate financial exposure

Regulatory Compliance Changes

The ongoing government shutdown and new administration policies create uncertainty around regulatory requirements. Small businesses face compliance risks in several areas:

- Tax law changes that affect deductions, credits, or reporting requirements

- Labor regulations including minimum wage, overtime rules, and classification standards

- Environmental and health regulations that may require operational changes

- Data privacy laws that impose new obligations for handling customer information

- Industry-specific regulations that vary by state and locality

Staying compliant requires ongoing attention to regulatory developments. Consider subscribing to industry newsletters, joining trade associations, and maintaining relationships with legal and accounting professionals who can alert you to relevant changes.

Cash Flow Disruption and Payment Delays

Economic uncertainty often leads to slower payment cycles as businesses and consumers become more cautious with cash. Small businesses may experience:

- Customers taking longer to pay invoices

- More requests for extended payment terms

- Increased rate of bad debts and uncollectible accounts

- Difficulty forecasting cash flow due to payment volatility

These challenges can create liquidity problems even for profitable businesses. Implementing strong accounts receivable management practices becomes crucial during uncertain economic times.

Action Steps

Review and Strengthen Your Cash Flow Management

Cash flow management should be your top priority in the current economic environment. Take these concrete steps:

Conduct a thorough cash flow analysis: Map out your expected cash inflows and outflows for the next 3-6 months. Identify any potential shortfalls before they become critical.

Accelerate receivables: Invoice promptly, offer discounts for early payment, and follow up consistently on overdue accounts. Consider implementing automated payment reminders.

Negotiate payment terms: Talk to suppliers about extended payment terms while simultaneously tightening payment terms for your customers.

Build a cash reserve: Aim to maintain at least 3-6 months of operating expenses in liquid reserves. This buffer can help you weather unexpected downturns or take advantage of sudden opportunities.

Eliminate unnecessary expenses: Review all recurring costs and cancel or renegotiate those that don’t directly contribute to revenue generation or critical operations.

Schedule a Consultation with Your Accountant

November is an ideal time to meet with your tax and financial advisors to review your current situation and plan for year-end. During this consultation, discuss:

- Tax planning strategies to minimize your 2025 tax burden

- Whether you should make additional purchases before year-end to maximize deductions

- Retirement account contributions and other tax-advantaged savings opportunities

- Your business structure and whether changes might benefit you

- Financial projections for 2026 and how to position for success

Professional guidance from accredited accountants can help you navigate complex tax laws and identify opportunities you might otherwise miss. Pro Tax Return offers expert tax advice tailored to small business needs, with 1:1 consultations that provide personalized strategies for your specific situation.

Modernize Your Financial Systems

If you’re still using manual processes or outdated software for invoicing, payments, or accounting, now is the time to upgrade. Modern financial management tools offer:

Digital invoicing: Create professional invoices quickly, track their status, and send automated payment reminders.

Multiple payment options: Accept credit cards, ACH transfers, mobile payments, and other methods that customers prefer.

Automated bookkeeping: Connect bank accounts and credit cards to automatically categorize transactions and generate financial reports.

Real-time financial visibility: Access current financial data anytime, anywhere, enabling faster and better-informed decisions.

Integration capabilities: Connect your financial systems with other business tools to eliminate duplicate data entry and reduce errors.

The initial investment in modern financial technology typically pays for itself within months through time savings, reduced errors, and improved cash flow.

Evaluate and Adjust Your Pricing Strategy

With inflation concerns persisting and potential tariff-related cost increases on the horizon, review your pricing to ensure it remains profitable:

- Calculate your true costs including labor, materials, overhead, and a reasonable profit margin

- Research competitor pricing to understand your market position

- Consider strategic price increases, particularly if your prices haven’t changed in over a year

- Communicate price changes proactively and professionally to customers

- Offer premium options or bundles that provide higher margins

- Eliminate unprofitable products or services that drain resources

Many small business owners underprice their offerings, especially when costs increase gradually over time. Regular pricing reviews ensure your business remains profitable and sustainable.

Invest in Cybersecurity Measures

Protecting your business from cyber threats is no longer optional. Take these essential steps:

- Implement multi-factor authentication on all business accounts

- Train employees to recognize phishing attempts and suspicious communications

- Establish a regular backup schedule for all critical business data

- Update all software and systems with the latest security patches

- Create and document incident response procedures

- Consider cyber insurance to transfer some of your risk

- Work with IT professionals to assess vulnerabilities and implement appropriate protections

The cost of prevention is always far less than the cost of recovery after an attack.

Explore Refinancing Options

With interest rates more favorable than they’ve been in recent years, now is an excellent time to explore refinancing:

- Contact multiple lenders to compare current rates and terms

- Calculate potential savings based on different rate scenarios

- Consider the costs of refinancing (application fees, origination fees, etc.) to ensure the savings justify the expense

- Evaluate whether to extend repayment terms for lower monthly payments or maintain shorter terms for less total interest

- Review prepayment penalties on existing loans that might affect refinancing decisions

Even if you don’t ultimately refinance, understanding your options provides valuable information for financial planning.

Enhance Your Online Presence

Whether or not you currently sell online, your digital presence affects customer perceptions and purchasing decisions:

- Audit your website for speed, mobile-friendliness, and ease of navigation

- Update your Google Business Profile with current information, photos, and regular posts

- Develop a consistent social media content strategy

- Collect and showcase customer reviews and testimonials

- Implement or improve your e-commerce capabilities

- Create valuable content (blog posts, videos, guides) that demonstrates your expertise

Your online presence works 24/7 to attract and convert customers, making it one of your most cost-effective marketing investments.

Conduct a Competitive Analysis

Understanding your competitive landscape helps you identify opportunities and threats:

- Research what competitors are doing well and where they’re falling short

- Analyze their pricing strategies and service offerings

- Monitor their online presence and customer feedback

- Identify gaps in the market that your business could fill

- Assess your unique value proposition and whether it remains compelling

This analysis might reveal opportunities to differentiate your business, serve underserved customer segments, or adjust your strategies to remain competitive.

Final Thoughts

The economic landscape of November 2025 presents both challenges and opportunities for small business owners. While market volatility, potential tariff impacts, and regulatory uncertainty create real concerns, the fundamentals for many small businesses remain strong. With 64% of small businesses reporting profitability and 51% planning expansion, there’s reason for optimism alongside caution.

The businesses that will thrive in this environment are those that stay informed, remain agile, and take proactive steps to position themselves for success. Regular market review isn’t about predicting the future with certainty—it’s about understanding current conditions well enough to make informed decisions and adapt quickly when circumstances change.

By monitoring key indicators like interest rates, consumer trends, competitive dynamics, and regulatory changes, you give yourself the information needed to recognize opportunities early and address threats before they become critical. This awareness, combined with strong financial management and strategic action, creates a foundation for sustainable business success.

Remember that you don’t have to navigate these complexities alone. Professional advisors, including experienced accountants and financial consultants, can provide valuable perspective and expertise. Whether you need help with tax planning, cash flow management, or strategic financial decisions, services like Pro Tax Return offer the personalized guidance that small businesses need to optimize their financial performance.

The months ahead may bring additional changes and challenges, but they’ll also bring new opportunities for businesses that are prepared, informed, and willing to adapt. Stay engaged with market trends, maintain financial discipline, invest in your people and systems, and keep your customers at the center of everything you do. These timeless principles, combined with awareness of current market conditions, will help your business not just survive but thrive in November 2025 and beyond.

Take action today on the steps outlined in this article. Review your cash flow, schedule that conversation with your accountant, explore refinancing options, and evaluate your technology systems. Each small step you take toward stronger financial management and strategic positioning compounds over time, creating sustainable competitive advantages that will serve your business well regardless of what the markets do next.

The future belongs to businesses that stay informed, adapt quickly, and execute consistently. Make frequent market review a habit, and you’ll find yourself better prepared to capitalize on opportunities and navigate challenges as they arise. Your business’s success depends not on perfect market conditions, but on your ability to make smart decisions based on current realities, and that ability starts with staying informed about the markets and economic trends that shape your business environment.