Accurate bookkeeping is one of the most critical pillars for small businesses in the U.S. While entrepreneurs focus on growing their companies, managing finances can quickly become overwhelming. From tracking expenses to complying with tax regulations, small business owners face many challenges. That’s where bookkeeping services for small businesses come in. These professional solutions help businesses maintain financial clarity, reduce errors, and optimize growth strategies.

In this blog, we’ll explore the importance of bookkeeping, the challenges small businesses face, and why outsourcing to professional bookkeeping services can transform your business and why affordable bookkeeping services for small businesses play a game-changing role.

Importance of Bookkeeping for Small Businesses

Bookkeeping is more than just “tracking expenses.” It’s the financial compass that guides small businesses toward profitability and stability. For U.S. businesses, where compliance with IRS regulations is non-negotiable, precise bookkeeping is a must. Without proper bookkeeping, businesses risk tax errors, missed deductions, cash flow problems, and legal penalties.

Starting your business on a strong financial foundation is key to long-term success. Accurate bookkeeping ensures that you can:

- Accurate Record Keeping: Accurate bookkeeping tracks all transactions including sales, expenses, receipts, and payments. Having detailed financial records gives a complete view of your company’s financial health. This visibility is crucial for growth planning, budgeting, and making strategic decisions.

- Informed Decision-Making: Well-maintained financial data allows small business owners to make informed decisions. You can identify profitable products, understand cost structures, and quickly react to market changes. With professional small business bookkeeping solutions, you get timely reports and insights for smarter business choices.

- Future Planning: Accurate bookkeeping is not only about assessing the present but also about preparing for the future. Small businesses can forecast revenue, plan expenditures, and allocate resources efficiently when they rely on consistent bookkeeping. Proper planning helps reduce financial risks and ensures stability.

- Growth Support: Growth requires strategic investment and careful cash flow management. With insights from professional bookkeeping, businesses can track patterns, optimize profits, and scale effectively. Outsourcing to affordable bookkeeping services allows business owners to focus on core operations while professionals manage finances.

With the rise of small business tax services and cloud bookkeeping software, business owners now have access to tools and professional help that make bookkeeping easier and more affordable than ever.

The Difficulties of Financial Management for Small Businesses

Small businesses face unique financial hurdles, often without the resources of larger corporations. Some of the most common challenges include:

- Unpredictable Cash Flow: Fluctuating revenue and irregular expenses make planning tough.

- Limited Resources: Many owners juggle multiple roles, leaving little time for bookkeeping.

- Tax Complications: IRS regulations are complex, and mistakes lead to penalties or lost deductions.

- Poor Record-Keeping: Inaccurate books cause delayed tax refunds and regulatory risks.

- Budgeting Issues: Lack of financial clarity can result in overspending and missed opportunities.

- Debt Management: Poor loan and credit oversight leads to excessive interest costs.

The Dangers of Poor Record-Keeping

Neglecting bookkeeping has serious consequences:

- Inaccurate Reporting: Leads to audits, legal fines, and compliance issues.

- Cash Flow Mismanagement: Misused resources and overextended credit are common.

- Higher Tax Burdens: Missed deductions mean overpaying taxes as the rules of tax are also changing and it’s important that the tax filing services in the USA must be taken to review all your records and data.

- Missed Growth Opportunities: Without reliable data, businesses can’t make informed investment decisions. Without Tax planning services business cannot take decisions especially in real-time evaluation so it’s essential to get online tax filing services by simply searching tax services near me or best tax services company in USA and connecting with ProTaxReturn experts by file taxes online or File Taxes through expert consultation and get the best tax services consultation.

Professional bookkeeping helps mitigate these risks and ensures small business financial management remains compliant and effective.

Legal Consequences of Poor Bookkeeping

The IRS requires accurate and complete financial records for every U.S. business. Poor bookkeeping may result in:

- Costly audits and penalties.

- Reduced eligibility for tax deductions.

- Late filing fees and interest charges.

- Fraud allegations or negligence claims for incomplete records.

Advantages of Outsourcing Bookkeeping Services

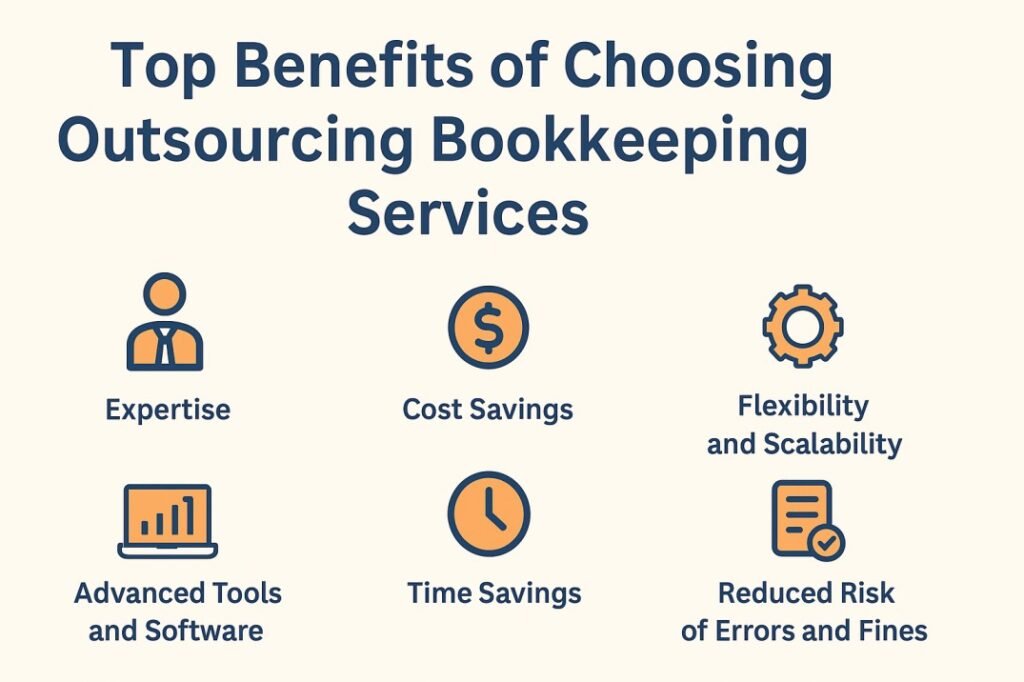

Outsourcing bookkeeping offers small businesses a cost-effective way to manage finances without hiring full-time staff. Benefits include:

- Expertise On-Demand: Professional bookkeepers handle complex financial tasks, including payroll, invoicing, bank reconciliations, and tax filings, ensuring compliance with U.S. laws.

- Cost Savings: Hiring an in-house accountant is expensive. Outsourcing provides access to expert knowledge at a fraction of the cost. Affordable bookkeeping services range from $250 to $2,500 per month, while in-house staff can cost $45,000–$60,000 annually.

- Advanced Tools: Outsourced bookkeepers use tools like QuickBooks, Xero, FreshBooks, and cloud bookkeeping software to reduce errors and automate tasks.

- Flexibility and Scalability: As your business grows, outsourcing allows you to scale services without hiring additional staff.

- Reduced Risk of errors and fines: Professional bookkeeping ensures compliance with tax laws and financial regulations, minimizing the risk of audits, penalties, or legal issues.

- Time Savings: Outsourcing bookkeeping frees up time for business owners to focus on strategy, sales, and growth initiatives.

Cost of Bookkeeping Services

Understanding costs helps businesses plan effectively:

- Outsourced Services: $250 – $2,500/month (based on size and complexity).

- Hourly Rates: $30 – $90/hour for professional bookkeepers.

- Software Subscriptions: Cloud-based tools from $15 – $70/month.

- In-House Bookkeepers: $45,000 – $60,000/year + benefits.

Investing in bookkeeping is an investment in financial clarity, risk reduction, and business growth.

ROI of Professional Bookkeeping Services

Affordable bookkeeping isn’t just an expense, it’s an investment. Benefits include:

- Avoiding Penalties: Prevent costly IRS fines and missed deadlines.

- Improved Cash Flow: Better tracking means smarter financial decisions.

- Business Growth: Accurate data supports expansion strategies.

- Time Efficiency: Focus on scaling your business instead of manual bookkeeping.

Outsourced bookkeeping is a smart financial strategy for small businesses aiming to maximize ROI while keeping operational costs low.

Bookkeeping vs. Accounting: What’s the Difference?

Many small business owners confuse bookkeeping with accounting. Here’s the distinction:

- Bookkeeping: Records financial transactions (sales, receipts, expenses).

- Accounting: Analyzes those records for strategy, compliance, and reporting.

Together, they create a powerful financial management system for small businesses.

Industry-Specific Examples of Bookkeeping

Different industries face unique financial challenges:

- Restaurants: Daily cash flow tracking and tip reporting.

- Freelancers/Gig Workers: Managing irregular income and deductions.

- E-commerce: Sales tax compliance across multiple states.

- Construction: Job-cost tracking and project-based budgeting.

Affordable bookkeeping services can be tailored to each industry’s needs.

The Role of Digital & Cloud Bookkeeping Tools

Modern bookkeeping uses advanced digital tools like QuickBooks, Xero, and FreshBooks. These:

- Automate expense tracking.

- Provide real-time financial dashboards.

- Enable secure cloud storage and IRS-ready reporting.

Outsourcing firms often include these tools in their service packages.

FAQs About Bookkeeping Services

Do small businesses really need bookkeeping?

Yes. Without accurate records, you risk tax penalties, cash flow problems, and missed opportunities.

Is outsourcing cheaper than hiring an in-house bookkeeper?

For most small businesses, yes. Outsourcing saves 30–50% of costs.

Can bookkeeping services help during IRS audits?

Absolutely. Organized, accurate records are your best defense.

What’s the best bookkeeping software for small businesses?

Popular choices include QuickBooks, Xero, and FreshBooks. Many services provide them at no extra cost.

What is bookkeeping for small businesses?

Bookkeeping involves recording all financial transactions, tracking income and expenses, and preparing reports for strategic planning and tax compliance.

How much do bookkeeping services cost?

Outsourced bookkeeping services cost $250–$2,500/month depending on complexity, while software subscriptions are $15–$70/month.

Can bookkeeping services help with taxes?

Yes. Bookkeepers prepare accurate financial reports, track deductible expenses, and work with tax professionals to reduce liabilities.

Should I hire in-house or outsource?

Outsourcing is cost-effective for most small businesses. It provides expertise, scalability, and access to advanced tools without full-time salaries.

What are the risks of poor bookkeeping?

Poor bookkeeping can lead to legal penalties, cash flow issues, missed tax deductions, and slowed growth.

Conclusion

Affordable and Accurate bookkeeping is essential for small businesses in the U.S. It transforms financial data into actionable insights, reduces risks, and supports growth. Outsourcing to professional bookkeeping services ensures compliance, cost savings, and reliable financial management.

By leveraging small business bookkeeping solutions, entrepreneurs can focus on growing their business, optimizing cash flow, and planning for long-term success.

If you’re looking to enhance your financial management and free up valuable time, it’s time to explore outsourced bookkeeping services. Contact our expert team today to discover tailored bookkeeping solutions for your small business!