Opening your mailbox to find an IRS Notice CP2000 can trigger immediate panic. Take a deep breath. This notice is not a bill and not an audit. It’s the IRS asking you to verify income discrepancies between what you reported and what they received from employers, banks, and other sources.

According to recent IRS statistics, over 4 million CP2000 notices are sent annually to U.S. taxpayers. Understanding how to respond correctly can save you thousands in penalties and interest.

What Is IRS Notice CP2000?

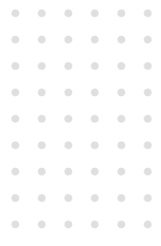

A CP2000 notice (officially called an “Underreporter Inquiry”) is an automated letter the IRS sends when third-party information doesn’t match your filed tax return. The notice proposes changes to your tax return and calculates additional tax you may owe.

The IRS receives copies of every W-2, 1099, and other income documents sent to you. Their computers match this information against your tax return. When something doesn’t align, the CP2000 is automatically generated. This is a proposal, not a final determination. You have the right to agree, disagree, or partially agree with the IRS findings.

Why Did I Get a CP2000 Notice?

Most CP2000 notices result from honest mistakes rather than intentional tax evasion. The most frequent issue is missing 1099 forms from freelance work, bank interest, or investment income that you forgot to include. Some taxpayers receive notices for unreported W-2 income from a second job, while others face questions about stock sales, cryptocurrency transactions, or retirement account distributions they didn’t properly report on their return.

Incorrect Social Security Numbers on tax documents can also trigger these notices, as can unemployment compensation or gig economy income from platforms like Uber and DoorDash. Many of these situations are completely fixable by with the right documentation as needed to know the Tax filing mistakes and how to avoid them.

CP2000 vs. IRS Audit: Understanding the Difference

A CP2000 notice is NOT an audit, and understanding this distinction can ease your stress significantly. The CP2000 is a computer-generated letter focused specifically on income matching issues. You can respond by mail with documentation, and the process is relatively informal and easier to resolve.

An IRS audit, by contrast, involves a human examiner who reviews your entire return and may require in-person meetings or extensive documentation. Audits are more comprehensive investigations that can result in serious consequences if fraud is suspected. If you ignore a CP2000, however, it could escalate to a formal audit, which is why responding promptly is critical.

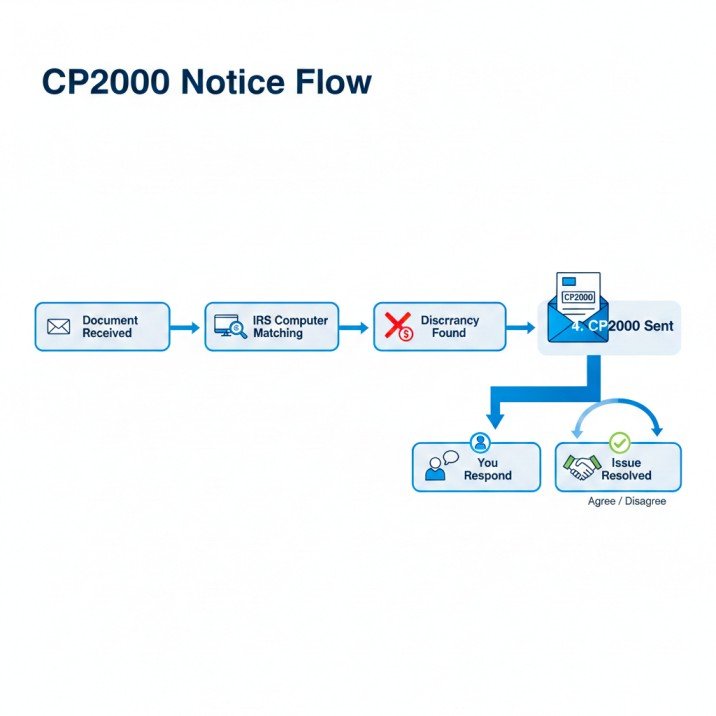

How to Read Your CP2000 Notice

Your notice contains several key sections that you need to understand. At the top, you’ll find the notice date and response deadline, which is typically 30 days from the notice date. The proposed tax changes section shows additional tax, penalties, and interest the IRS believes you owe. There’s an income comparison chart that lists what the IRS has on record versus what you reported on your return.

The response form is where you’ll indicate whether you agree, disagree, or partially agree with the IRS findings. Finally, if you owe additional tax, the notice includes payment options. The most important detail is the notice date at the top right corner because your response deadline is calculated from this date, not from when you actually received the notice in the mail.

Step-by-Step: How to Respond to a CP2000 Notice

Step 1: Don’t Panic – You Have Options

You have three response options available. You can agree if the IRS is correct and you owe the additional tax. You can disagree if you believe the IRS is wrong. Or you can partially agree if some information is correct but not all of it.

Step 2: Gather Your Tax Documents

Collect your original tax return and all income documents including W-2s, 1099s, bank statements, and receipts. Compare what you reported against what the IRS claims you should have reported. This careful review will help you determine which response option is appropriate for your situation.

Step 3: Verify the Discrepancy

If you actually forgot to report income and the IRS is correct, check the “agree” box on the response form and arrange payment. The IRS offers payment plan options if you can’t pay in full, so don’t let financial concerns prevent you from responding.

If you did report the income but the IRS missed it, attach a copy of your original return with the income highlighted and add a brief explanation. Sometimes income is reported under the wrong Social Security Number, in which case you should provide documentation proving the income wasn’t yours. If the IRS has incorrect figures, attach supporting documents showing the correct amounts.

Step 4: Write Your Response Letter

Here’s a sample CP2000 response letter you can adapt to your situation:

[Your Name]

[Your Address]

[City, State ZIP]

[Your Phone Number]

[Date]

Internal Revenue Service

[Address from CP2000 Notice]

Re: IRS Notice CP2000

Tax Year: [Year]

SSN: [Last 4 digits only] XXX-XX-XXXX

Dear Sir or Madam:

I am responding to CP2000 Notice dated [date] regarding my [year] tax return.

After reviewing the notice and my records, I [agree/disagree/partially agree] with the proposed changes for the following reasons:

[If you agree:]

I agree with the proposed changes. I inadvertently failed to report [specific income] from [source]. I have enclosed payment of $[amount] or request a payment plan.

[If you disagree:]

I disagree with the proposed changes. The income in question was properly reported on my original return on Line [number]. I have attached a copy of my return with the entry highlighted for your review.

[If you partially agree:]

I partially agree with the proposed changes. The income from [source A] was correctly identified as unreported. However, the income from [source B] was properly reported on my original return. I have enclosed documentation supporting my position.

I have attached the following supporting documents: [List each document]

Please review my response and adjust the proposed assessment accordingly. If you need additional information, please contact me at [phone number].

Thank you for your attention to this matter.

Sincerely,

[Your Signature]

[Your Printed Name]

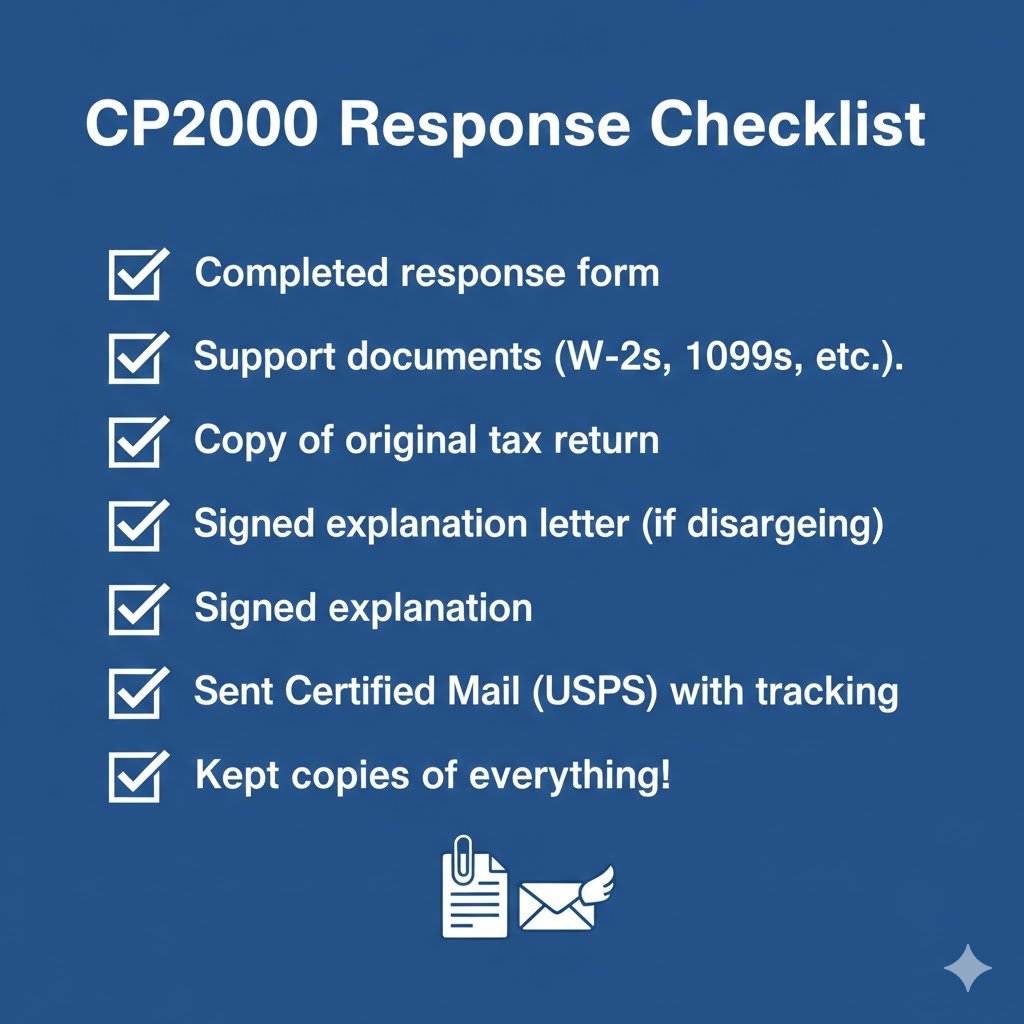

Step 5: Send Your Response

Mail your response to the specific address on the CP2000 notice, not the regular IRS address. Include copies of supporting documents but never send originals. Send everything via certified mail with return receipt so you have proof of delivery. Keep copies of everything you send, and make sure to respond within 30 days to avoid additional penalties.

What Happens After You Respond?

The IRS typically takes 30 to 90 days to review your response. You may receive an agreement letter if the IRS accepts your explanation and closes the case. Sometimes they’ll send a revised CP2000 with adjusted proposed changes. If you didn’t respond or the IRS disagrees with your explanation, you’ll receive a Statutory Notice of Deficiency, which is your final notice before they assess the tax.

If you receive a Statutory Notice of Deficiency, you have 90 days to petition the U.S. Tax Court. This is definitely when you should consult professional tax services for expert guidance.

Common CP2000 Mistakes to Avoid

The worst mistake you can make is ignoring the notice completely. Missing the deadline results in automatic assessments, so timely response is crucial. Many taxpayers fail to provide adequate documentation to support their claims, which leads to rejection. Always send copies of documents and keep your originals safe. Make sure you fill out every section of the response form completely.

For self-employed individuals and freelancers dealing with 1099 issues, check out our guide on how freelancers can save more on taxes.

When to Hire a Tax Professional

Consider getting professional help if the proposed tax increase is over $5,000, if you’re confused about whether the IRS is correct, or if you need to file an amended return. Multiple IRS notices or cases involving complex investments or business income are also good reasons to seek expert assistance. Affordable professional tax filing services can help you navigate CP2000 notices and negotiate with the IRS on your behalf.

Preventing Future CP2000 Notices

Keep organized records of all income documents throughout the year. Report all income on your tax return, even small amounts that might seem insignificant. Double-check Social Security Numbers on all forms before filing. Consider using professional bookkeeping services to track income accurately, and file your return electronically for automatic error checking.

Understanding USA tax deductions for 2025 can also help ensure you’re reporting everything correctly from the start.

Final Thoughts

Receiving an IRS Notice CP2000 isn’t the end of the world. It’s simply a request to verify information. By responding promptly with proper documentation, most taxpayers can resolve these notices quickly and often reduce or eliminate the proposed tax increase.

Don’t let fear cause you to ignore the notice. Take action within the 30-day window, and if you need help, our team at Pro Tax Return specializes in IRS notice responses and tax resolution.

Need help responding to your CP2000 notice? Contact us today for expert assistance, or explore our comprehensive tax services designed for individuals and businesses across the United States.

Related Articles: 2026 Tax Season: Critical IRS Deadlines Every US Taxpayer Must Know, IRS Tax Updates 2025, 5 Signs It’s Time to Hire a Tax Expert

About Pro Tax Return: We provide professional, affordable tax services to individuals, freelancers, small businesses, and US expats nationwide. With IRS-authorized preparers and expert bookkeeping services, we make tax filing simple and stress-free. Get started today.