At ProTaxReturn, we provide accurate and reliable tax services in California, tailored to individuals, families, and businesses. From Los Angeles and San Francisco to San Diego, Sacramento, and Irvine, our team ensures your tax filings comply with federal and state regulations while helping you maximize deductions, credits, and avoid costly mistakes.

California’s tax system is one of the most complex in the nation, with high income tax rates, property tax considerations, and intricate business tax obligations. Without expert guidance, individuals and businesses risk overpaying or missing critical deadlines. That is where ProTaxReturn comes in delivering clarity, compliance, and year-round support.

Why California Residents Need Professional Tax Services

California taxpayers face challenges that differ from other states due to high state income tax rates, local taxes, and business obligations. Key concerns include:

- High state income tax: California has one of the highest progressive tax systems in the U.S., ranging from 1% to 13.3% depending on income.

- Property taxes: Proposition 13 limits annual increases, but homeowners must still navigate assessments and relief programs.

- Business taxes: Corporations, LLCs, and small enterprises face varying income tax, franchise tax, and sales tax requirements.

- Cross-state employment: Residents commuting to neighboring states like Nevada or Oregon may need careful reporting to avoid double taxation.

Having an experienced California tax professional ensures you take advantage of all deductions and credits available while remaining fully compliant.

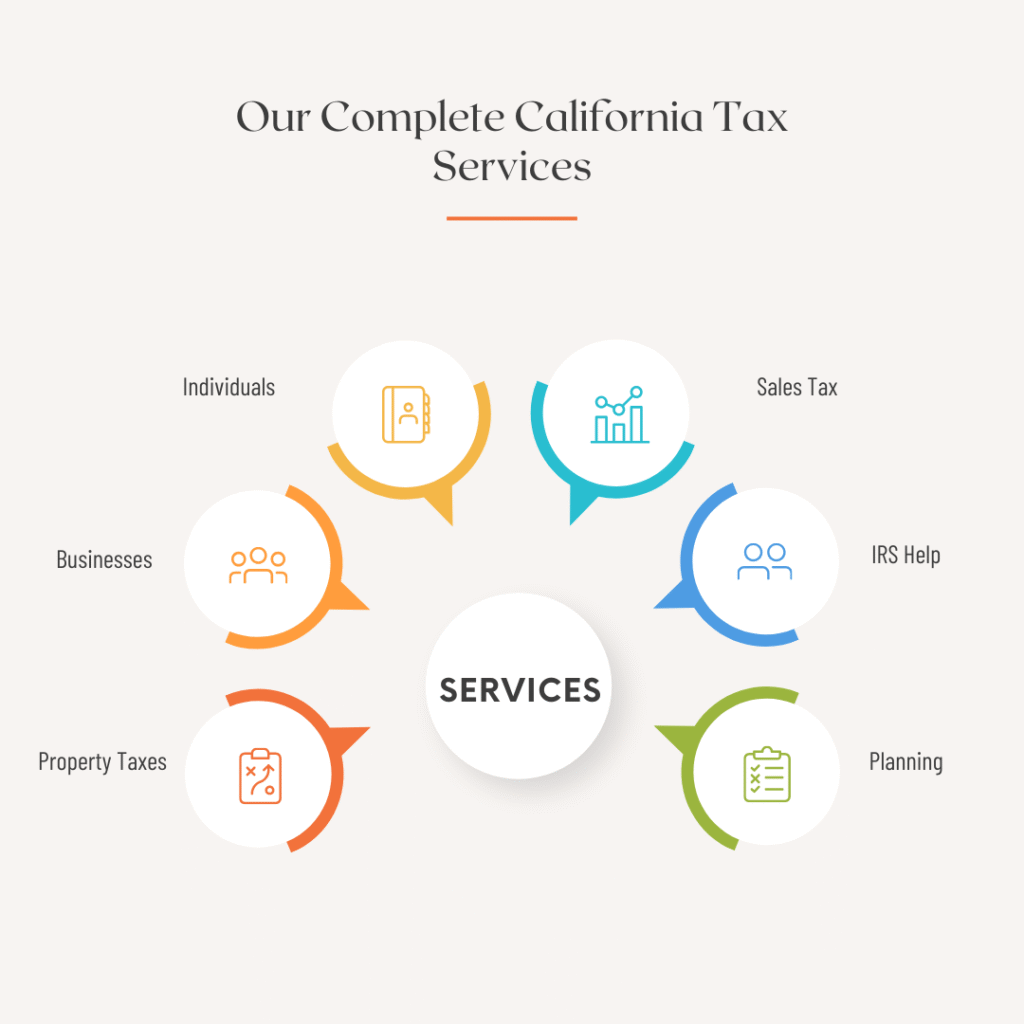

Our Complete California Tax Services

ProTaxReturn offers a comprehensive range of tax services designed for individuals, small businesses, and corporations across California.

Individual Tax Filing

Whether you are a first-time filer or a seasoned taxpayer, we handle both state and federal returns. We maximize credits such as:

- California Earned Income Tax Credit (CalEITC)

- Property Tax Assistance Programs

- Education-related deductions including 529 plan contributions

For example, a California freelancer in Los Angeles was able to save $3,500 on state taxes by using our expert guidance on home office deductions, business expenses, and education credits.

Business Tax Filing

California businesses must navigate corporate income tax, LLC fees, and sales tax obligations. We ensure compliance and optimize your financial position with strategic planning.

- Small business credits: R&D credits, investment credits

- Sales tax reporting: Accurate monthly or quarterly filings for retail and e-commerce

- Franchise tax compliance: For corporations and LLCs

For instance, a startup in San Francisco was able to reduce its tax liability by $12,000 by correctly applying R&D and employee tax credits.

Property Tax Support

California homeowners face complex property tax rules under Proposition 13. Our experts ensure accurate filings and guide clients through relief programs like:

- Homeowners’ Exemption

- Mello-Roos Community Facilities District

We also assist with property reassessment appeals, which can save residents thousands of dollars.

Sales and Use Tax Filing

Retailers, restaurants, and e-commerce businesses benefit from our accurate sales and use tax services. We handle:

- Monthly, quarterly, and annual filings

- Nexus-based reporting for multi-state businesses

- Compliance with California Department of Tax and Fee Administration (CDTFA) regulations

IRS and State Problem Resolution

From IRS audits to California Franchise Tax Board disputes, we represent clients professionally and work toward fast resolution. Our team handles:

- Back taxes

- Penalty abatement

- Audit representation

Year-Round Tax Planning

We help individuals and businesses plan for future tax seasons with strategies including:

- Income and investment planning

- Retirement savings optimization

- Business operations advice

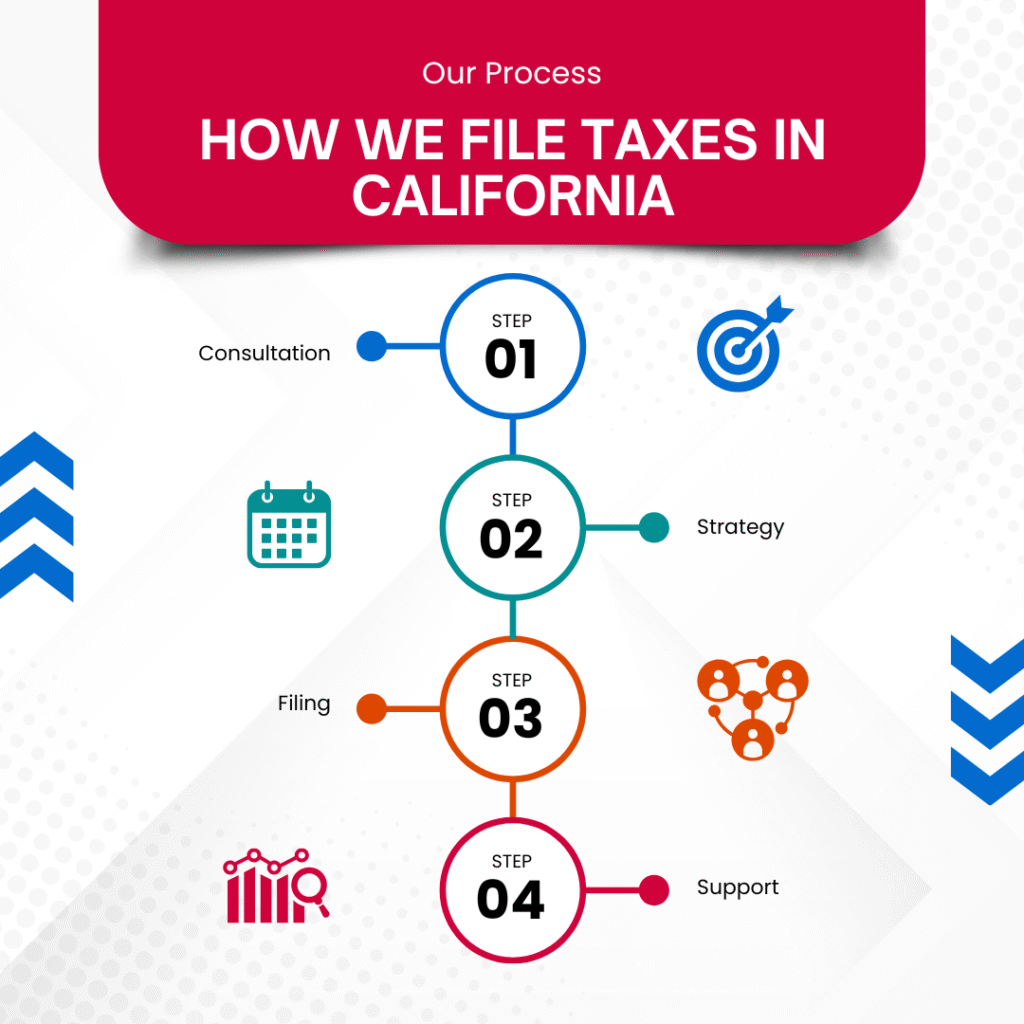

How We File Taxes in California – Our Process

Our transparent, step-by-step approach makes tax filing simple and stress-free.

- Consultation & Document Review

We assess prior returns, income, expenses, and any IRS or Franchise Tax Board notices. - Strategy & Deduction Mapping

We identify all available California deductions and credits, such as energy-efficient home credits, dependent care, and student loan interest. - Accurate Preparation & Filing

All returns are prepared with precision and submitted securely to both the IRS and California state systems. - Ongoing Support

We provide year-round guidance, ensuring clients stay compliant and prepared for future tax cycles.

Industries We Serve in California

Our tax expertise spans California’s diverse economy, including:

- Technology and Startups: San Francisco, Silicon Valley, and San Diego

- Entertainment and Media: Los Angeles-based companies, film, and production studios

- Tourism and Hospitality: Hotels, resorts, and restaurants across California

- Healthcare and Pharmaceuticals: Biotech and medical device companies

- Construction and Real Estate: Property development and real estate investors

- Freelancers and Contractors: Independent workers in all sectors

By tailoring tax strategies to industry needs, we help clients stay compliant while maximizing their financial position.

Local Knowledge – The California Advantage

Working with a California tax service means understanding state-specific rules and opportunities:

- California-specific tax credits and exemptions

- City-based differences in Los Angeles, San Francisco, San Diego, and Sacramento

- Property tax and Proposition 13 guidance

- Cross-border tax filings for residents working in other states

- Small business incentives offered by California

Our local expertise ensures every return is accurate, compliant, and optimized.

Real-World Examples and Figures

- The average California household saves $1,500 annually by correctly claiming property tax exemptions.

- Freelancers in Los Angeles and San Diego have saved $2,000 to $5,000 by leveraging home office and business expense deductions.

- Startups in Silicon Valley can reduce state tax liability significantly using R&D and investment credits.

By combining local knowledge, strategic planning, and careful review, ProTaxReturn helps clients retain more of their hard-earned money.

FAQs About California Tax Services

When is the California state tax deadline?

It typically matches the federal April deadline, but extensions can be filed.

Are property tax exemptions available?

Yes, homeowners may qualify for exemptions like the Homeowners’ Exemption or senior property tax relief programs.

Do California residents working in another state pay taxes twice?

No. Credits for taxes paid to other states help prevent double taxation.

Can I file California taxes online?

Yes, ProTaxReturn offers secure online filing for individuals and businesses.

Does ProTaxReturn handle FTB disputes?

Absolutely. We represent clients in audits, back-tax negotiations, and penalty resolution.

Start Your California Tax Filing Today

Don’t let California’s complex tax system overwhelm you. Our experienced tax professionals are ready to help you file accurately and confidently.

📧 Email: info@protaxreturn.com

🌐 Website: https://protaxreturn.com

✔ Local California tax expertise

✔ Proven track record of accuracy and compliance

✔ Transparent pricing — no hidden fees

✔ Options for in-person and secure online filing

✔ Year-round guidance and advisory